WERNER ENTERPRISES (WERN)·Q4 2025 Earnings Summary

Werner Misses on Revenue and EPS, But FirstFleet Deal Dominates the Narrative

February 5, 2026 · by Fintool AI Agent

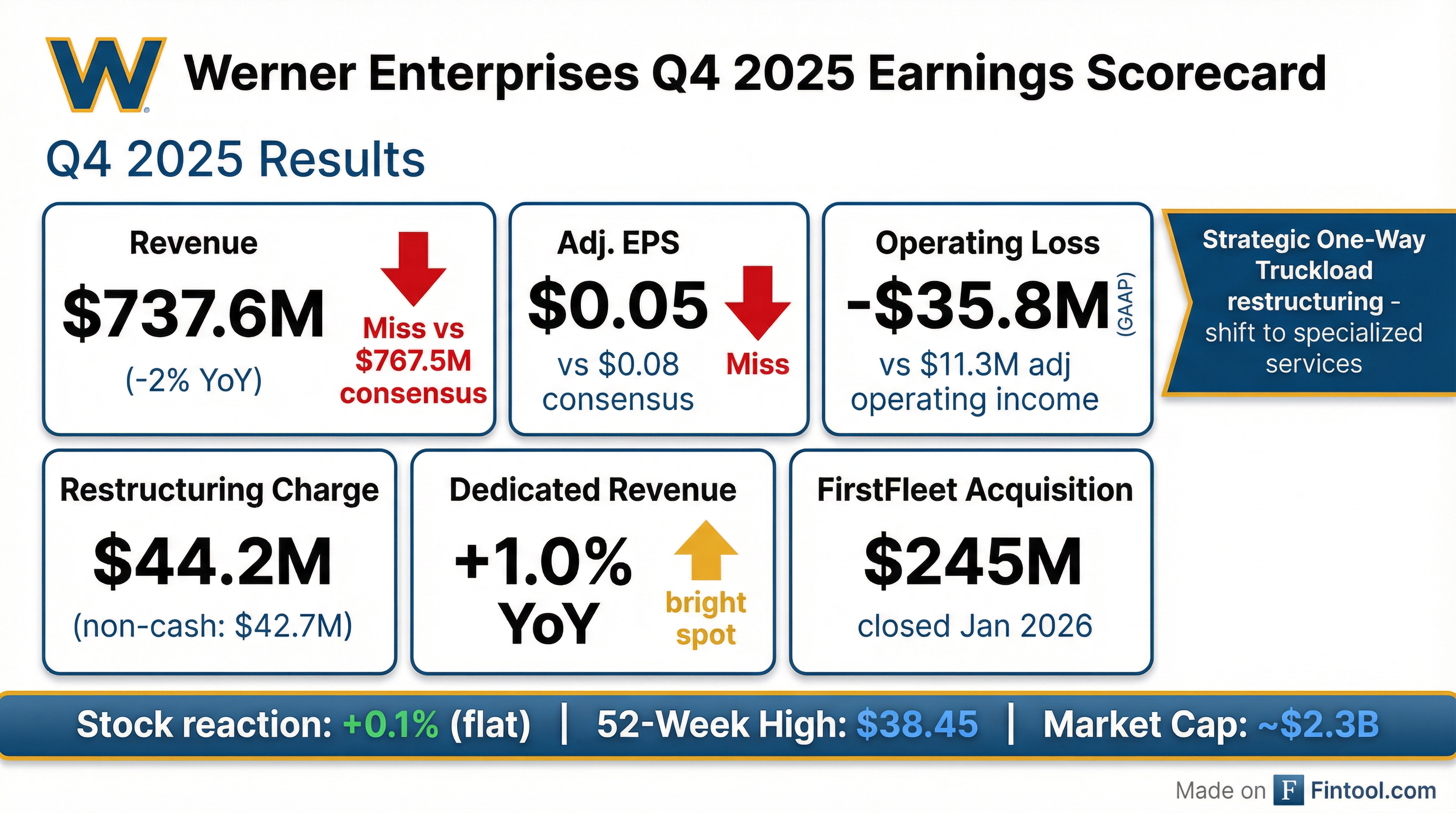

Werner Enterprises (NASDAQ: WERN) reported Q4 2025 results that missed on both revenue and earnings, but the stock barely budged—trading flat at $37.87, just pennies from a 52-week high. The reason: investors are looking past a messy quarter weighed down by a $44.2M restructuring charge and focusing on the transformational FirstFleet acquisition that closed last week.

The quarter was ugly on the surface—a GAAP loss of $0.46 per share, operating loss of $35.8M, and revenue down 2% YoY. But strip out the restructuring noise and Werner delivered $0.05 in adjusted EPS on $11.3M of adjusted operating income, roughly in line with a freight market that remains deeply challenged.

Did Werner Beat Earnings?

No. Werner missed on both key metrics:

The miss was driven by a confluence of factors: a smaller One-Way Truckload fleet following strategic exits from unprofitable freight, margin compression in Truckload Brokerage, and the $44.2M restructuring charge that hit GAAP results.

This marks Werner's 7th miss in the last 8 quarters on EPS—the lone beat was Q2 2025 when the company posted $0.11 vs $0.05 expected.

What Drove the Quarter?

The $44.2M Restructuring Charge

The headline number investors need to understand: Werner took a $44.2M restructuring charge in Q4 to strategically reposition its One-Way Truckload business.

The good news—$42.7M was non-cash:

- $21.7M intangible asset impairment

- $21.0M revenue equipment write-down

This restructuring involved:

- Exiting unprofitable regional and short-haul truckload freight

- Integrating one-way acquisition operations

- Shifting fleet composition toward specialized, Expedited, and team capacity

The goal is straightforward: stop losing money on commoditized freight and focus on higher-margin specialized services where Werner has pricing power.

Segment Performance

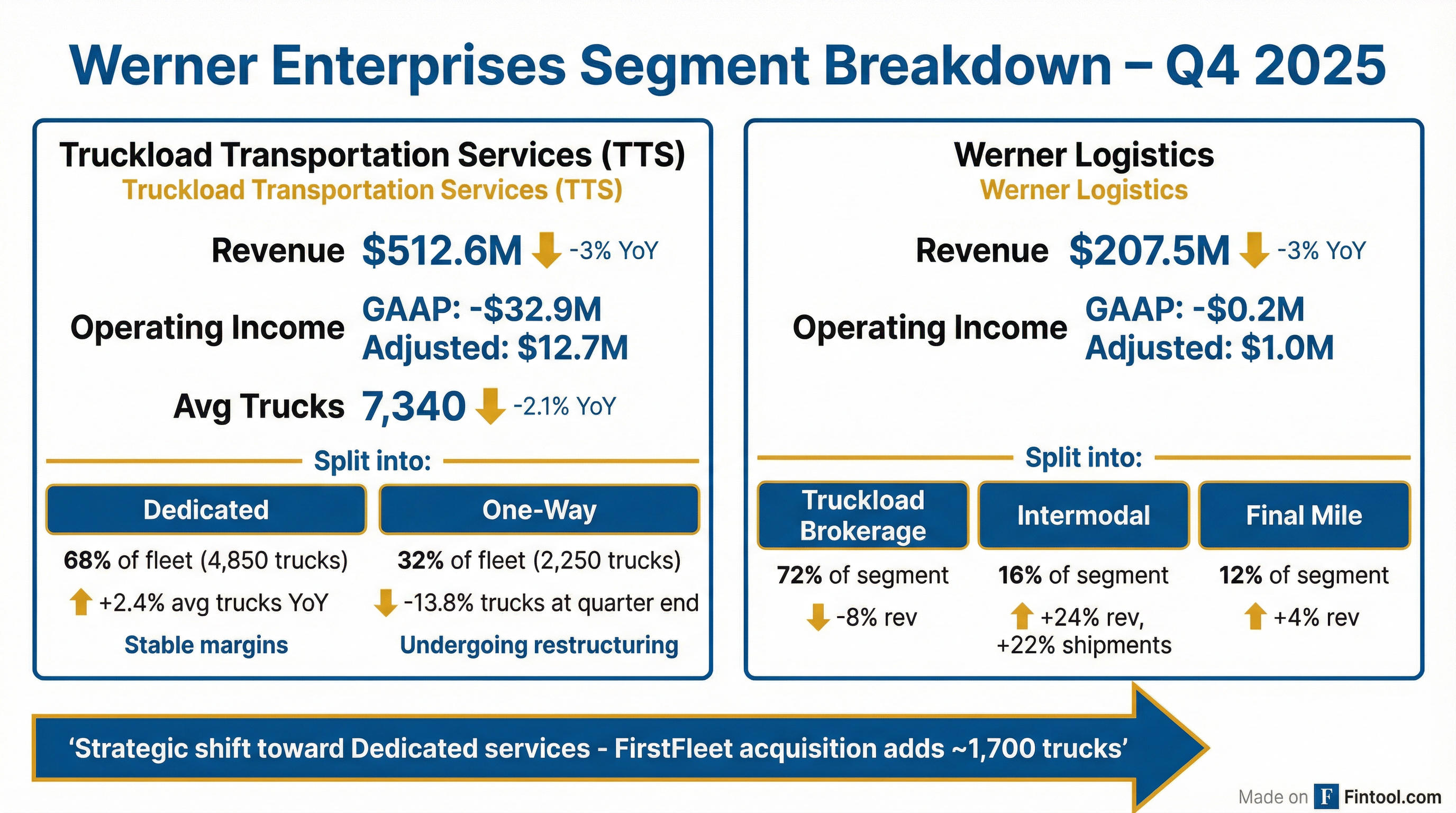

Truckload Transportation Services (TTS): Revenue fell 3% YoY to $512.6M, with operating loss of $32.9M (GAAP) vs adjusted operating income of $12.7M.

TTS adjusted operating margin, net of fuel surcharge, was 2.8% (down 30 bps YoY), with adjusted operating ratio of 97.2%. Year-end TTS fleet was 7,100 trucks, down 4.7% YoY.

The divergence within TTS tells the real story:

Dedicated is the story management wants you to focus on—stable revenue, improving margins, and about to get a massive boost from FirstFleet.

Revenue Per Truck Per Week (RPTPW) Trends:

While Dedicated RPTPW was flat YoY, One-Way productivity improved 2.2% as Werner exited unprofitable freight.

Werner Logistics: Revenue fell 3% YoY to $207.5M with a small operating loss. The mixed bag:

Werner PowerLinks™ volumes decreased 10% YoY and 23% sequentially. Adjusted operating margin fell to 0.5% (down 60 bps) due to lower volumes and gross margin compression.

The FirstFleet Acquisition: Why Investors Don't Care About the Miss

Werner closed the FirstFleet acquisition on January 27, 2026 for a total of $282.8M ($245M for the operating company + $37.8M for real estate).

This is the strategic pivot that has the stock at 52-week highs:

What FirstFleet Brings:

- Top-11 pure-play dedicated trucking company in North America

- Positions Werner as the 5th largest dedicated carrier in the U.S.

- Shifts revenue mix to 52% dedicated (from 43%)

- Expected $18M in annual synergies within first two years

Financing:

- Total purchase price: $282.8M ($245M operating company + $37.8M real estate)

- Includes $35M earnout measured and paid after March 2027

- Funded with cash on hand + incremental debt

- Total debt increased ~$190M in January 2026 (revolver borrowing + assumed capital leases)

- Post-deal revolver + A/R facility borrowings: $884.6M

CEO Derek Leathers frames the dedicated market as a "$30 billion-plus total addressable market that is more resilient, contract-based, and protected by high barriers to entry."

Customer Stickiness: FirstFleet's top 10 customers average 17-year tenure, with three of the top four customers onboard for over 25 years. This dedicated model is "very difficult to displace and replicate," giving Werner confidence in customer retention.

How Did the Stock React?

Essentially flat. WERN closed at $37.87, up just 0.11% on the day despite missing estimates.

But context matters:

The stock has rallied ~65% from its 52-week lows, pricing in the freight cycle recovery and the FirstFleet transformation story. Analysts remain cautious—16 have a Hold rating with a mean price target of $32.33, implying 15% downside from current levels.

What Did Management Guide?

Werner provided 2026 guidance alongside results, incorporating FirstFleet:

The massive jump in truck count (+23-28%) is almost entirely FirstFleet, which adds ~2,400 trucks. Management expects modest pricing improvement in One-Way Truckload in 1H26 as the freight market continues to gradually recover.

Quarterly Progression: Management signaled Q2 as the earnings inflection point. Q1 faces headwinds from Winter Storm Fern (worse than $0.04 EPS drag from Q1 2024 storm) and ongoing restructuring completion. Expect momentum to build as the year progresses from both market support and internal restructuring benefits.

2026 Modeling Assumptions

Management provided additional modeling assumptions for 2026:

Note: Equipment gains expected to stabilize at lower levels with improvement in 2H26, as the company plans to sell more tractors and trailers.

Balance Sheet & Cash Flow

Liquidity breakdown: $642M available credit + $60M cash = $702M total liquidity. Debt is 50% effectively fixed-rate and all scheduled to mature in 2027.

Werner maintained operating cash flow despite the challenging freight environment, though it declined significantly from prior years:

Free Cash Flow History ($M):

The increase in CapEx vs prior year was due to lower equipment sale proceeds (sold 45% fewer tractors, 47% fewer trailers).

Fleet Age: Average truck age of 2.7 years and trailer age of 5.6 years—keeping the fleet young supports driver experience, safety, and fuel efficiency.

Net Debt to EBITDA Progression:

Leverage has steadily increased as EBITDA declined (from $618M in 2021 to $349M in 2025) while debt remained elevated. The FirstFleet acquisition will add incremental debt, making deleveraging dependent on margin recovery.

Key Management Quotes

"We see signs of encouragement for the industry and Werner as we move into 2026... the outlook for Werner in 2026 is more positive than it's been for several years."

— Derek Leathers, Chairman and CEO

"Fourth quarter results reflect both the challenges and progress made during a difficult operating year. Dedicated revenue continued to grow, supported by increased fleet size and customer retention, and the recently announced acquisition of FirstFleet positions Werner for further sustainable, profitable growth."

— Derek Leathers, Chairman and CEO

"We're not abandoning one-way, but we are a leaner, more agile version of ourselves, complemented now with a growing and more capable set of PowerLink carriers."

— Derek Leathers, Chairman and CEO

"Capacity exits continue, driven in part from ongoing broad enforcement efforts, and recent tightening between supply and demand suggests that that pace is increasing."

— Derek Leathers, Chairman and CEO

Full Year 2025 Summary

2025 was a difficult year for Werner and the trucking industry broadly. The freight recession that began in 2022 continued to pressure rates and volumes. Werner's strategic response—doubling down on Dedicated while restructuring One-Way—sets up a cleaner P&L for 2026.

Forward Estimates

Analysts expect a meaningful recovery in 2026, driven by FirstFleet accretion and a slowly improving freight market:

*Values retrieved from S&P Global.

Full year 2026 estimates: ~$0.83-$1.00 EPS on ~$3.1-3.2B revenue, representing a significant rebound from 2025's adjusted loss.

What Changed From Last Quarter?

The key change: management pulled the trigger on restructuring the One-Way business and closed the FirstFleet deal. Both are designed to improve the quality of earnings going forward.

Looking Ahead to Q1 2026: Management warned of headwinds from Winter Storm Fern, which was worse than the Q1 2024 storm (~$0.04 EPS drag). At the storm's peak, 50% of Werner's tractor fleet was parked. However, "pop-up demand" from storm aftermath provides some offset, and restructuring benefits begin flowing through by Q2.

Capital Allocation Philosophy

Werner's capital allocation over 2021-2025 shows disciplined reinvestment:

The Board approved a new 5 million share repurchase program in August 2025, with all shares remaining available.

Q&A Highlights

The analyst Q&A revealed several important details management didn't emphasize in prepared remarks:

On Q1 2026 Headwinds

Winter Storm Fern Impact: CFO Chris Wikoff noted that "about 50% or half of our tractor fleet was parked over the weekend" at the storm's peak—unprecedented for Werner. Management sized the Q1 2024 storm impact at ~$0.04 EPS drag; this storm was worse.

Logistics Margin Squeeze: Purchased transportation costs "remained relatively high" in January, with ongoing gross margin pressure in Truckload Brokerage. Management expects this to "moderate as we work through customer pricing agreements."

On Earnings Inflection Timing

CEO Derek Leathers pointed to Q2 as the earnings inflection point: "The restructuring work that was done in Q4 takes a while to bear fruit... That's why we pointed toward Q2 as kind of where you see a more material inflection in earnings."

The One-Way restructuring is expected to be "largely complete by the end of the first quarter" with benefits "noticeable in Q2, but for sure in the second half, that would be more noticeable and accelerating."

On Freight Market Recovery

Management provided bullish color on capacity tightening:

"When you see rejection rates as recently as today crest 14%, that's relatively unprecedented territory. We're starting to be in the world of COVID-like rejection rates at a number like that."

— Derek Leathers, CEO

Even stripping out storm impact (2-4%), rejection rates are "still sitting at double the average rejection rate of what we've seen for multiple years in a row."

On contract renewals: mid-single digit increases on a like-to-like basis. Werner is willing to walk from unprofitable business—spot market currently offers $0.25/mile premium over contract rates.

On FirstFleet Integration

Customer Retention Confidence: Leathers emphasized FirstFleet's deep customer relationships: "Among its top 10 customers, the average tenure is 17 years, and three of its top four customers have been with FirstFleet for over 25 years."

Margin Convergence Timeline: Management has "a line of sight to FirstFleet's margins converging with Werner's traditional dedicated margins over the next, call it, 18-24 months."

Synergy Realization: Expects about one-third of $18M cost synergies realized within calendar 2026, on a two-thirds run rate by year-end. That alone represents ~300 bps of margin improvement when fully realized.

Earnout Structure: $35M of the purchase price is an earnout "that will be measured and, if earned, it will be paid after March 2027."

On One-Way Rate Per Mile Guidance

The flat to +3% revenue per total mile guidance for One-Way in 1H26 is muted by mix shift: longer length of haul (Mexico cross-border, team expedited) comes with lower rate per mile despite higher value. On a like-to-like contract renewal basis, rates are up mid-single digits.

Risks & Concerns

- Leverage Increase: Total debt up ~$190M from FirstFleet financing; revolver at $885M

- Q1 Storm Headwind: Winter Storm Fern impact worse than Q1 2024; 50% of fleet parked at peak

- Integration Execution: FirstFleet synergies ($18M) must be realized on schedule

- Freight Market Timing: Recovery expectations could disappoint if macro weakens

- Analyst Skepticism: Mean price target of $32.33 implies 15% downside

- Payout Ratio: Dividend payout ratio reported at 136.6%—unsustainable without earnings recovery

The Bottom Line

Werner's Q4 2025 was a messy quarter on the surface—revenue and EPS misses, a $44M restructuring charge, and ongoing freight market headwinds. But the market looked through the noise to the transformation story: a strategic exit from unprofitable One-Way freight and the FirstFleet acquisition that makes Werner a dedicated trucking powerhouse.

The stock at 52-week highs and a flat reaction to a miss tells you what investors care about: the 2026+ setup, not the 2025 cleanup. Whether Werner can deliver on FirstFleet synergies and execute the One-Way turnaround will determine if the current valuation is justified.

Conference call: February 5, 2026 at 5:00 PM ET

Related Links: